Average earnings excluding bonuses rose at an annual rate of 7.8% from June to August 2023 – welcome news for some amid the cost of living crisis.

This is one of the fastest annual growth rates since records began in 2001, according to the UK’s Office for National Statistics.

It comes alongside a cooling in inflation, meaning that salaries are now rising faster than prices for the first time since 2021.

New annual inflation figures for the United Kingdom are set to be released tomorrow, with economists predicting a jump from 6.7% in August to 6.5% in September.

Whilst this may be promising, it’s still well above the Bank of England’s 2% target.

Whose wages are rising the most?

The pay increase is an average, meaning that the benefits aren’t shared by everyone.

The finance and business sector saw the largest annual regular growth rate at 9.6%, followed by the manufacturing sector at 8.0%.

On the other end of the scale, construction workers saw the lowest raise compared to other industries, with a 5.7% increase.

Average wage growth for construction workers was the lowest compared to other industries at 5.7% between June and August.

The construction industry has been hit particularly hard by high interest rates and soaring energy costs.

In the private sector as a whole, wages rose by an average of 8.0%, and for the public sector, pay growth was at 6.8%.

This second figure is the highest it has been since comparable records began in 2001, and it can partially be explained by one-off payments made to the NHS staff (national healthcare workers) and civil service employees.

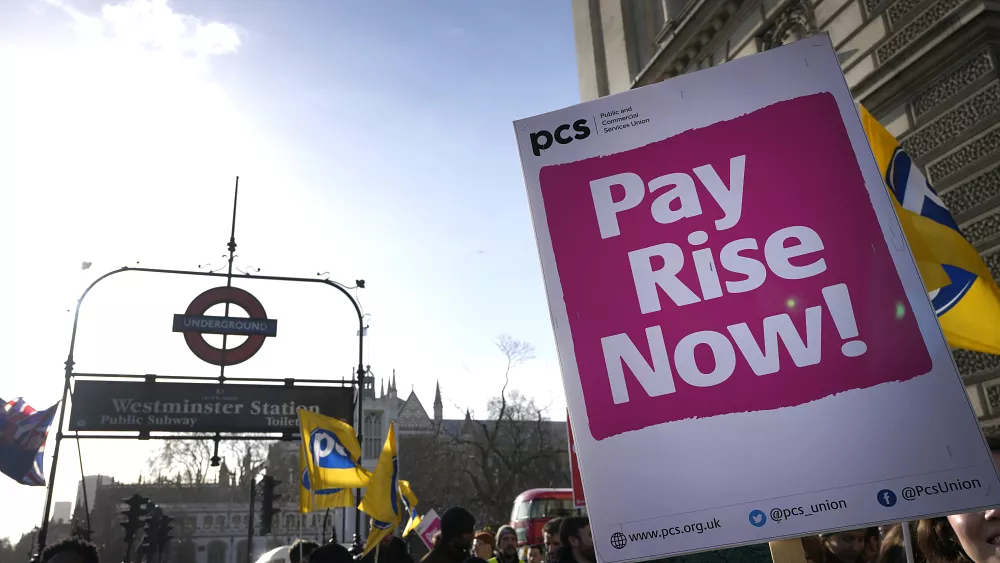

Following a string of strikes, the government agreed to pay extra money to these workers in June, July, and August, in part to compensate them for years of pay stagnation.

Will wage growth last?

The UK’s Chancellor Jeremy Hunt celebrated the news that inflation is falling while real wages are on the rise, stressing that “people have more money in their pockets”.

That said, experts believe that a declining jobs market could mean pay growth starts to slow.

UK companies are becoming increasingly reluctant to hire new staff, and there were 43,000 fewer job vacancies in September compared to July.

This is the 15th consecutive period in which vacancies have declined.

With economists predicting further rises in unemployment and higher interest rates on the horizon, wage figures are likely to be less positive in the coming months.