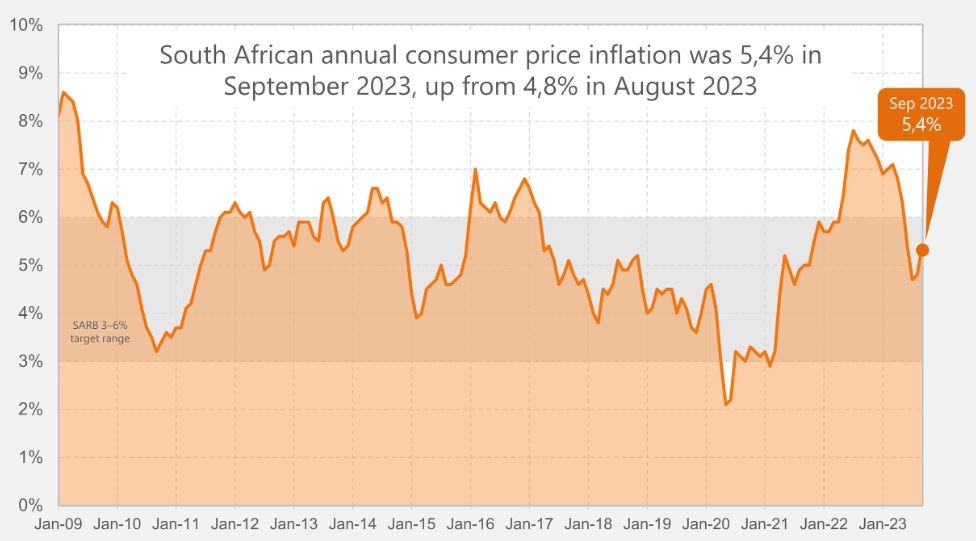

Annual consumer price inflation ticked up to 5.4% in September from 4.8% in August, the second consecutive increase. It was in line with economists’ expectations.

Source: Statistics SA

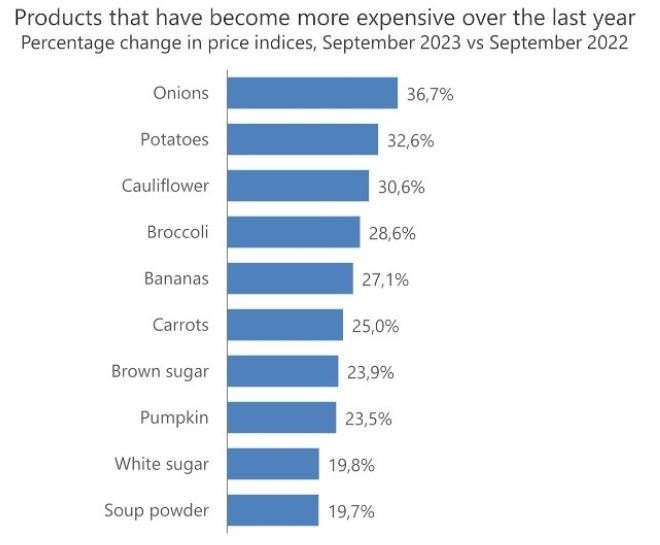

The main contributors to the increase were food and non-alcoholic beverages, which increased 8.1% year-on-year, housing and utilities, miscellaneous goods and services and transport, according to Stats SA.

Source: Statistics SA

Source: Statistics SA

The sizable step up in CPI doesn’t bode well for interest rates, which are already at a 14-year high. In the twice-yearly Monetary Policy Review, which was published this week by the Reserve Bank, it was noted that “upside risks have strengthened in recent months, heightening uncertainty about the precise path for inflation”.

Not only have oil prices risen sharply, inflation expectations remain elevated and together with the increased intensity of load-shedding, that could feed into wages and prices.

Oil prices remain volatile as fighting between Israel and Hamas militants in Gaza continues. If the conflict spreads more widely throughout the oil-rich Middle East, there will be heightened risks for supply, meaning that crude prices may rise further.

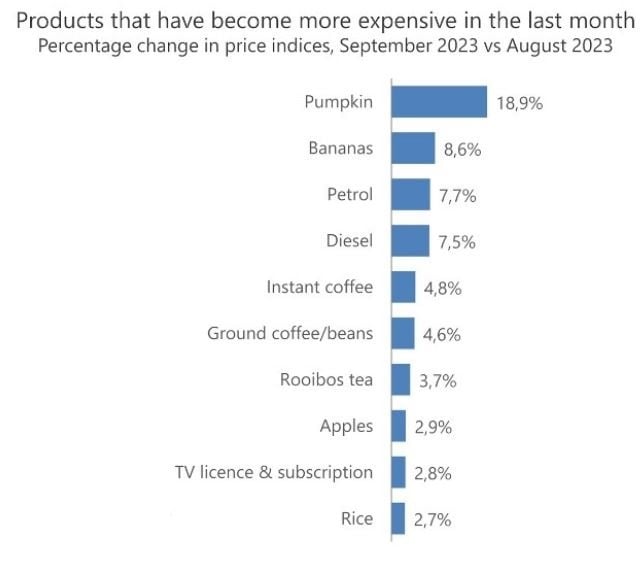

Nonetheless, this will take time to feed into the South African economy and the latest figures from the Central Energy Fund suggest petrol prices could be cut by about R1.90 a litre in November, while diesel prices might be lowered by between 69c and 75c a litre.

The monthly change in the consumer price index was 0.6%.

“South Africa is also likely to experience drier weather conditions this year which could adversely impact domestic food production, particularly the 2023–24 summer harvest, with the effects likely exacerbated by the risks associated with global food markets,” the Reserve Bank’s report said, suggesting the Monetary Policy Committee may be compelled to hike interest rates.

A Reuters poll earlier this month showed economists expect the Reserve Bank to wait until either January or March before it considers cutting the country’s repurchase rate, which is currently at 8.25%.

On 23 November the Monetary Policy Committee will announce what is scheduled to be its last interest rate decision for the year.