Nigeria is currently experiencing its worst economic crisis in a generation, leading to widespread hardship and anger.

The trade union umbrella group, the Nigeria Labour Congress (NLC), has organised nationwide protests on Tuesday, calling for more action from the government.

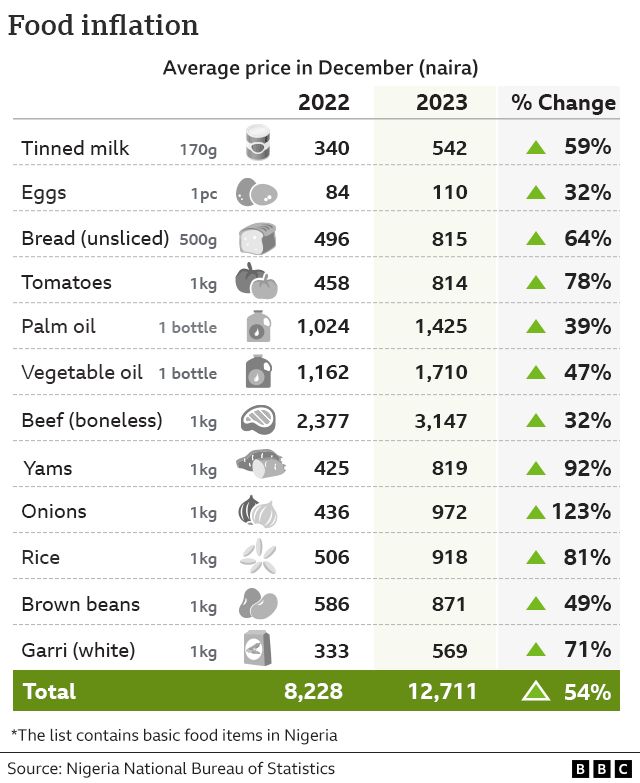

A litre of petrol costs more than three times what it did nine months ago, while the price of the staple food, rice, has more than doubled in the past year.

These two figures highlight the difficulties that many Nigerians are facing as wages have not kept up with the rising cost of living.

Like many nations, Nigeria has experienced economic shocks from beyond its shores in recent years, but there are also issues specific to the country, partly driven by the reforms introduced by President Bola Tinubu when he took office last May.

How bad is the economy?

Overall, annual inflation, which is the average rate at which prices go up, is now close to 30% – the highest figure in nearly three decades. The cost of food has risen even more – by 35%.

However, the monthly minimum wage, set by the government and which all employers are supposed to observe, has not changed since 2019, when it was put at 30,000 naira – this is worth just $19 (£15) at current exchange rates.

Many are going hungry, rationing what food they have or looking for cheaper alternatives.

In the north, some people are now eating the rice that is normally discarded as part of the milling process. The waste product usually goes into fish food.

Widely shared social media videos indicate how some are reducing portion sizes.

One clip shows a woman cutting a fish into nine pieces rather than the average four to five. She is heard saying her goal is to ensure her family can at least eat some fish twice a week.

What is causing Nigeria’s economic crisis?

Inflation has soared in many countries, as fuel and other costs spiked as a result of the war in Ukraine.

But President Tinubu’s efforts to remodel the economy have also added to the burden.

On the day he was sworn in nine months ago, the new president announced that the long-standing fuel subsidy would be ending.

This had kept petrol prices low for citizens of this oil-producing nation, but it was also a huge drain on public finances. In the first half of 2023, it accounted for 15% of the budget – more than the government spent on health or education. Mr Tinubu argued that this could be better used elsewhere.

However, the subsequent huge jump in the price of petrol has caused other prices to rise as companies pass on transportation and energy costs to the consumer.

One other factor that is pushing up inflation is an issue that Mr Tinubu inherited from his predecessor, Muhammadu Buhari, according to financial analyst Tilewa Adebajo.

He told the BBC’s Newsday programme that the previous government had asked the country’s central bank for short-term loans to cover spending amounting to $19bn.

The bank printed the money, which helped fuel inflation, Mr Adebajo said.

What has happened to the naira?

Mr Tinubu also ended the policy of pegging the price of the currency, the naira, to the US dollar rather than leaving it up to the market to determine on the basis of supply and demand. The central bank was spending a lot of money maintaining the level.

But scrapping the peg has led the naira’s value to plunge by more than two-thirds, briefly hitting an all-time low last week.

Last May, 10,000 naira would buy $22, now it will only fetch around $6.40.

As the naira is worth less, the price of all imported products has gone up.

When will things get better?

While the president is unlikely to reverse his decisions on the fuel subsidy and the naira, which he argues will pay off in the long run by making Nigeria’s economy stronger, the government has introduced some measures to ease the suffering.

Nigeria’s Vice-President Kashim Shettima announced the establishment of a board charged with controlling and regulating food prices. The government also ordered the national grain reserve to distribute 42,000 tonnes of grains, including maize and millet.

This is not the first time the government has said it is distributing aid to poor and vulnerable Nigerians, but labour unions have often criticised the government’s method of food distribution, saying much of it does not reach poor families.

The government has also said it is working with rice producers to get more of it into markets and customs officials have been instructed to cheaply sell off bags of the grain that they have seized. In a sign of how bad things are, on Friday this led to a crush in the biggest city, Lagos, which killed seven people, local media report. These hand-outs have now been halted.

The rice was seized under the previous government, which banned imports of rice to encourage local farmers to grow more. That ban was lifted last year in at attempt to bring down the cost but because of the fall in the value of the naira, that has not worked.

Around 15 million poorer households are also receiving a cash transfer of 25,000 naira ($16; £13) a month, but these days that doesn’t go very far.